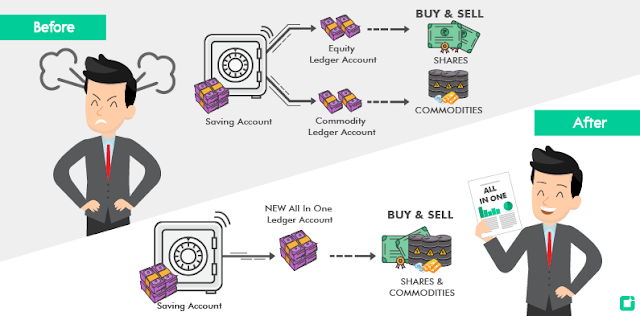

In today’s article, we will learn to trade with a single

margin equity and commodity trading account.

So what is the benefit?

Currently

We need to maintain 2 trading accounts, one for equity

trading and other for commodity trading. This is a big headache as it would

result in frequent transfers that are time-consuming, costly, requires more

working capital and inefficient use of funds. This, eventually results in loss

of opportunity that is of great importance in the Stock market with price movement’s

happen

ings in split seconds.

So to overcome this hurdle Tradejini has introduced a single

margin trading account to trade all financial products with one account.

Let’s look at the below scenarios to understand better:

Buy Scenario:

Mr. A has Rs. 80,000 in a savings account. He intends to trade

in both, equity and commodity for which he has transferred Rs. 50,000 in equity

account whereas the remaining to his commodity account of Rs. 30,000.

The next day due to an uptrend in the equity market he intends

to buy shares worth Rs. 65, 000 but is limited to the account balance of Rs.

50,000 in his equity account. So in order to purchase the shares, he has to do an

additional transfer of Rs. 15,000 from his registered bank account only as it is

not possible to transfer money from his commodity margin account to equitymargin account within a day.

Margin Scenario:

Mr. B has Rs. 1, 60,000 in a savings account and intends to

trade in equity and commodity. So he has divided the amount equally and

transferred Rs. 80,000 to equity account and the remaining Rs. 80,000 to his

commodity account.

Now, He has entered into 2 open positions where one is inequity and the other is a commodity. The margin requirement for both these

positions is Rs. 80, 000 each.

Suppose at end of the day he faces a loss of Rs. 30, 000 on

his commodity position and a profit of Rs. 50, 000 on his equity position and

as a result of this the end of the day commodity ledger balance would be Rs.

50, 000 (80, 000 - 30, 000) and equity ledger balance would be Rs. 1, 30, 000

(80, 000 + 50, 000).

In the above scenario, he can safely carry forward his

equity position to the next day as he has sufficient margin amount but he will

have to deposit the loss amount of Rs. 30, 000 in his commodity account in

order to maintain the required margin to carry forward his commodity position

to the next day failing which his position would be squared off by the broker.

So, he will have to conduct an additional transfer of Rs.

30,000 to his commodity margin account from his registered bank account only as

it is not possible to transfer money from equity margin account to

commodity margin account within a day.

In the New Scenario

SEBI has allowed trading in equity and commodity market via

a single entity. So brokers who provide equity and commodity trading facility

can integrate both their companies into one entity which will allow traders to

trade-in equity and commodity via a single company thus a single margin

account.

Let’s recall both the before scenarios and see the benefits

of this change

Buy Scenario:

Mr. A has Rs. 80,000 in saving accounts and intends to trade

in equity and commodity. This time rather than dividing and transferring the

amount between equity and commodity account, he can transfer the complete Rs. 80,000

to a single all in one margin account.

The next day due to an uptrend in the equity market he intends

to buy shares worth Rs. 65, 000 and this time he can easily buy those shares as

the complete money are in all in one margin account.

Margin Scenario:

Mr. B has Rs. 1, 60,000 in saving account and intends to

trade-in equity and commodity. This time rather than dividing and transferring

the amount between equity and commodity account he can transfer the complete

Rs.1, 60,000 to a single all in one margin account.

He has entered into 2 open positions where one is inequity

and the other is a commodity. The margin requirement for both these positions

is Rs. 80, 000 each so a total of Rs.1, 60,000.

Suppose at end of the day he faces a loss of Rs. 30, 000 on

his commodity open position and a profit of Rs. 50, 000 on his equity open

position. So his end of the day all in one margin account balance would be Rs.1,

80,000 (1, 60, 000 + 50, 000 – 30, 000.)

In the above scenario, he can safely carry forward both his

equity and commodity positions to the next day as he has sufficient ledger

amount to meet his margin requirement.

So, with the new, all in one margin account he need not like

before transferring, money between equity and commodity account and this will savethe additional money i.e. transfer charge and also the additional time and

inconvenience.

Welcome to the new chapter of trading

https://bit.ly/2WVhDaI

Comments

Post a Comment